2025 progress report on Newrest’s commitment to cage-free eggs and the ECC

America

|America

The Newrest Group operates in more than fifty countries around the world through various activities. It deals with a variety of local contexts, marked by specific regulations and cultures. This diversity is considered in the achievement of its overall objectives.

Cage-Free Eggs

For several years, Newrest has been taking concrete actions to achieve its objective: sourcing exclusively egg products from cage-free hens by 2025.

The results presented below illustrate the ongoing efforts of our teams to find alternatives in all countries despite the major challenges related to the cage-free egg production sector. However, major supply constraints remain, particularly in certain geographic areas where supply is still insufficient or associated with high costs. In general, these results reflects the maturity of the production capacities in each region where we operate. Between October 2024 and March 2025, sourcing of cage-free eggs reached 23.4%, up from 13% in fiscal year 2024.

In an international context marked by disparities in access to responsible supply chains, the group is developing national partnerships to stimulate the production of cage-free eggs, especially in areas where supply remains limited. This approach strengthens the resilience of supply chains while ensuring compliance with Newrest’s quality standards.

A Regional and Country-by-Country Approach

As part of our approach, we initiated a progressive strategy—first regional, then national—aimed at refining the identification of cage-free egg products. This work is carried out in close collaboration with representatives of national and international organisations committed to animal welfare, whose market expertise allows us to better understand the availability of viable alternatives to our products.

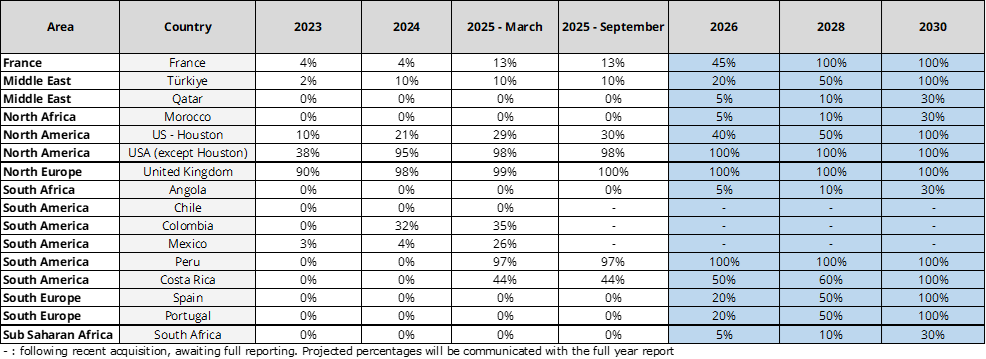

Compared to the previous period, Newrest recorded a significant increase in its sourcing of cage-free egg, with an improvement of 10 percentage points. This momentum is especially strong in South America, where Peru—the leading market in the region—now achieves 100% cage-free egg purchases. In North America, notable progress has also been observed: Mexico (our historical airline catering activity) and Costa Rica reached 26% and 44% respectively, illustrating an encouraging evolution in the region.

Some regions of the world are still face structural or temporary barriers to developing cage-free egg supply chains. The lack of local production in the Middle East and North Africa limits the achievement of the group’s overall objective. In Europe, despite significant progress, gaps remain in some countries. In Asia, climatic events disrupted yields, reducing available supply. Finally, in sub-Saharan Africa, while Nigeria has now reached 100% by importing all the products concerned, occasional shortages, particularly in Gabon, are affecting the overall results of the area. In Gabon, as well as in Laos, the group has provided financial and technical support to small businesses to encourage the emergence of cage-free egg production that meets our quality standards. However, these initiatives remain exposed to unpredictable climatic and economic factors, which limit regular supply and impact progress toward the group’s goal.

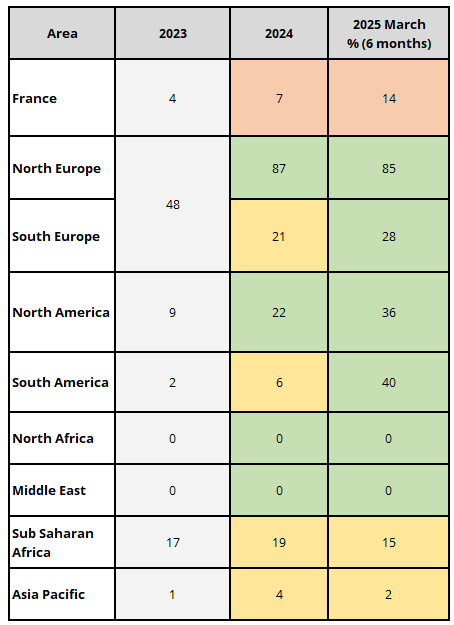

Regional breakdown of data collected for the first six months of Newrest's 2025 fiscal year (October 2024 – March 2025):

As suggested by The Humane League and to ensure greater continuity in the assessment of its performance, the Group relies on information from the Global Coalition for Animal Welfare (GCAW). The report, published in December 2023, provides a better understanding of cage-free egg production capacity in the countries in which Newrest operates. The colors in the table above reflect Newrest’s performance in purchasing cage-free eggs, in relation to the production capacity of these countries..

Reference document : Cage Free Eggs: A GCAW Global Landscape Review.

- Orange = % of Newrest’s purchases of cage-free egg products are lower than the area’s production capacities

- Yellow = % of Newrest’s purchases of cage-free egg products are slightly lower than the area’s production capacities

- Green = % of Newrest’s purchases of cage-free egg products are equal to or greater than the area’s production capacities

A Product Category Approach

To accelerate the achievement of tangible results, the group is focusing its efforts on countries representing 80% of egg product purchases. In-depth studies have therefore been launched to assess local production capacities in these priority areas, as well as the types of egg products used, to best adapt our responsible sourcing strategy.

The transition to cage-free eggs is already fully achieved in some identified countries. Conversely, other strategic markets, such as Morocco — which accounts for nearly 20% of the group’s purchases of egg products — do not currently have any compliant local supply chains. In addition, in the context of some of our activities, the specific requirements of certain customers for processed products may limit our ability to select products. These constraints require constructive dialogue, particularly with airlines, to identify solutions that are compatible with our commitments.

In collaboration with regional associations, efforts are underway in the relevant countries to identify reliable suppliers and increase the volume of cage-free egg product purchases.

Next steps

Focusing our efforts

Based on these observations, the group is now focusing on 16 countries representing 80% of egg product purchasing volumes and decided to approach the issue by product type to facilitate the identification of viable alternatives.

Here is a detailed timeline of objectives for these 16 countries where our egg product sourcing is concentrated:

– France: the transition has begun with several references (in particular liquid eggs) switching to cage-free from October 1, 2025. This initiative will increase the cage-free supply rate to 45% by 2026.

– Spain and Portugal: discussions are underway with national partners to identify and opt for products, mostly processed, as viable substitutes.

– United States – Houston: discussions are underway with national partners to identify viable processed substitute products to offer to our sole client.

– Chile / Colombia / Mexico: Newrest has carried out an external growth operation in these three countries. More than 600 million euros in additional annual revenue has significantly increased the purchasing volume of egg products. No product currently meets our commitment; as a result, the group anticipates a significant drop in performance for the full year 2025 (October 2024 – September 2025) and will be able to evaluate the impact for 2026. We are already working with partners to identify areas for improvement and target products.

– Morocco: notable lack of available solutions. We remain vigilant and continue discussions with regional partners.

– South Africa: Discussions are underway with national suppliers to identify financially viable alternatives.

– Turkey / Qatar / Angola : Notable lack of available solutions. We remain vigilant and continue discussions with regional partners.

Explore alternatives in other countries

Certain obstacles in some regions limit our progress toward our objectives, mainly due to a lack of necessary infrastructure or high costs. Nevertheless, the group is fully committed to sourcing cage-free egg products.

Aware of on-the-ground realities and the varying capacities of each country, Newrest will announce its ambitions for these countries upon publication of the full-year 2025 figures.

Newrest is committed to continuing to publish updated information on this subject every six months.

European Chicken Commitment

Since 2019, the group has been committed to animal welfare by joining the European Chicken Commitment (ECC), which imposes higher standards for farming and slaughter than current regulations.

Despite encouraging progress—with 15% of chickens (fresh, frozen, and processed) purchased between October 2024 and March 2025 meeting ECC standards—a majority of suppliers are still unfamiliar with the criteria, which remains a challenge.

The group continues its efforts to raise awareness and conducts further research to identify viable alternatives, in collaboration with its partners. After investigation, most suppliers will not be fully operational until 2026, highlighting the need for a comprehensive transformation of the ecosystem.

Our ambition remains unchanged: to build, together with all sectors, a supply chain aligned with ECC standards.

en

en

fr

fr es

es